The choice to go green is everywhere these days. Many of us have likely swapped a product or a company in favor of a more environmentally friendly option. We may pick up reusable bags rather than plastic, and choose organic produce instead of traditionally farmed. These choices give support to companies that are making the change we want to see in the world. The power of consumer choice is important.

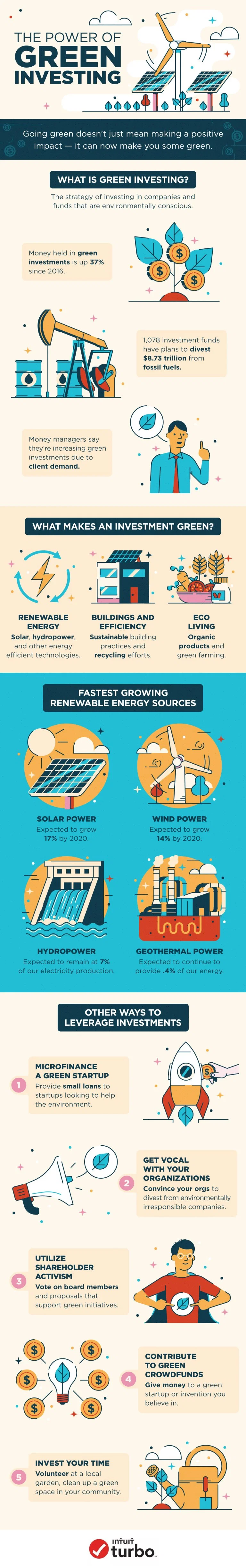

As where you put your money speaks volumes, there’s also another way to use your money for environmental good - green investing. This is a method of investing in companies that strive to help protect the environment and our natural resources. This style of investing has grown rapidly in popularity in recent years, as a global push towards environmentalism skyrockets. Now not only can green investing help the environment, but it can also help you, too.

An investment is typically thought to be green when the company derives most of its revenue from the environmentally friendly practices or products. Classic examples include solar energy or wind power companies. This could also include companies that develop new technologies to help the environment, like those removing microplastics from the ocean.

Aside from those pure-play options, some green investors may also choose to support companies who aren’t necessarily in a green industry but have eco-friendly practices and policies in place. For example, a clothing manufacturer who sources cotton that is grown organically and sustainably.

Since there is some room for gray area, what ultimately makes an investment green enough is up to you. If you don’t want to endlessly research individual companies’ policies, you also have the option of investing in a green fund.

For more insights on green investing, check out this infographic by Turbo.

You may also like

The Benefits of Investing in Eco-Friendly Properties

7 Common Misconceptions about Solar Energy

The Future of Architecture: 9 Sustainability Trends to Explore